Eliminate Noise, Surface Risk

Looking Glass is Portfolio Intelligence: Software for fund managers that monitors portfolio performance, surfaces insights, saves time, and cuts down on costs. More About Looking Glass ⇓

Looking Glass is Portfolio Intelligence: Software for fund managers that monitors portfolio performance, surfaces insights, saves time, and cuts down on costs. More About Looking Glass ⇓

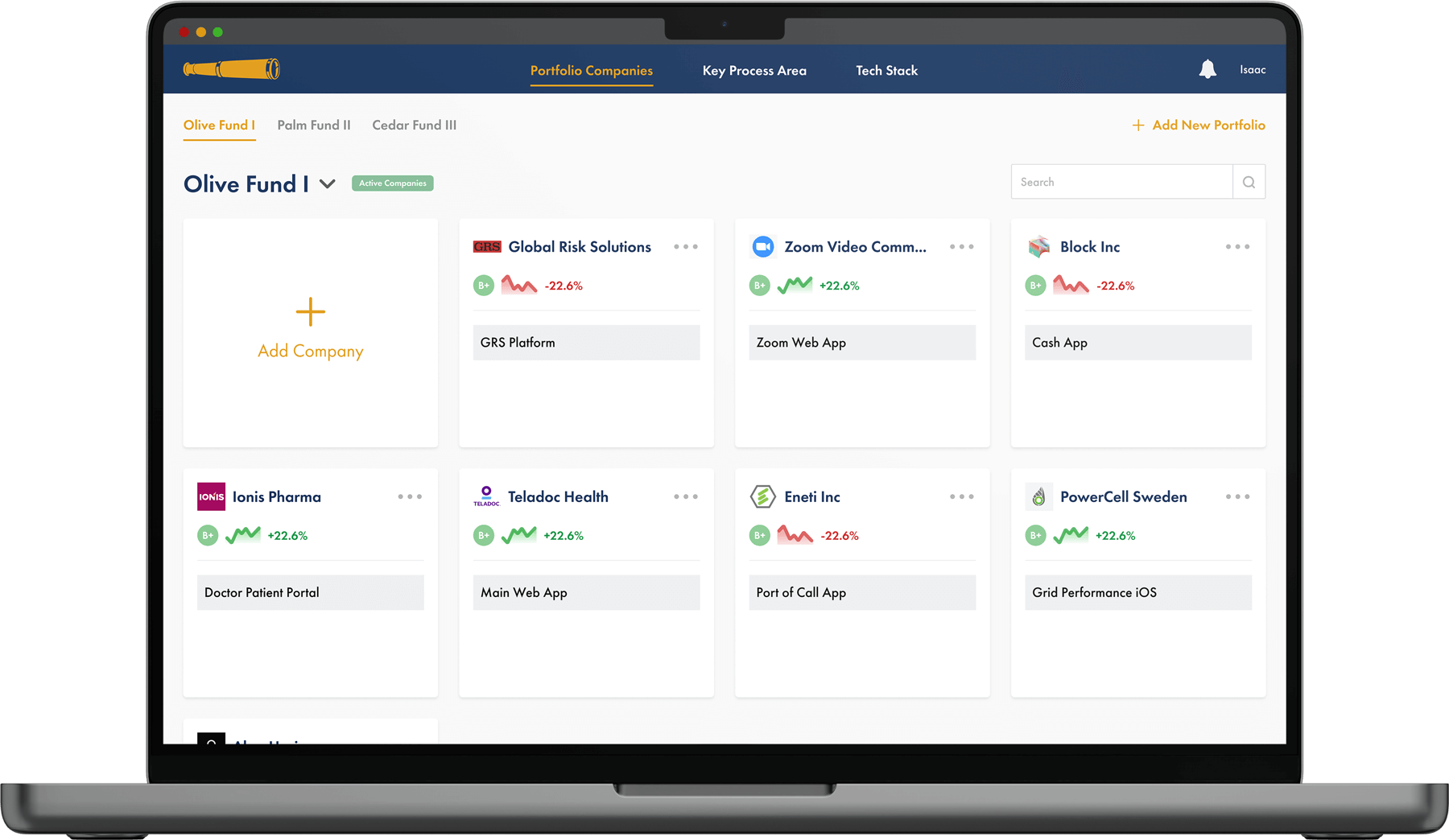

Streamline your analysis post-investment: The platform allows portfolio managers to catch potential issues before they happen so they can capitalize on growth and work to ensure high returns. Find Out More ⇓

"Eighty percent of deals we review in our diligence process have technical debt that would impede their GTM timeline." B2B SaaS VC Fund Manager

As the number of their investments grows, portfolio managers must divide their time and attention among portfolio companies. Looking Glass gives fund managers their time back — now, attention can be paid to specific needs and specific portfolio companies.

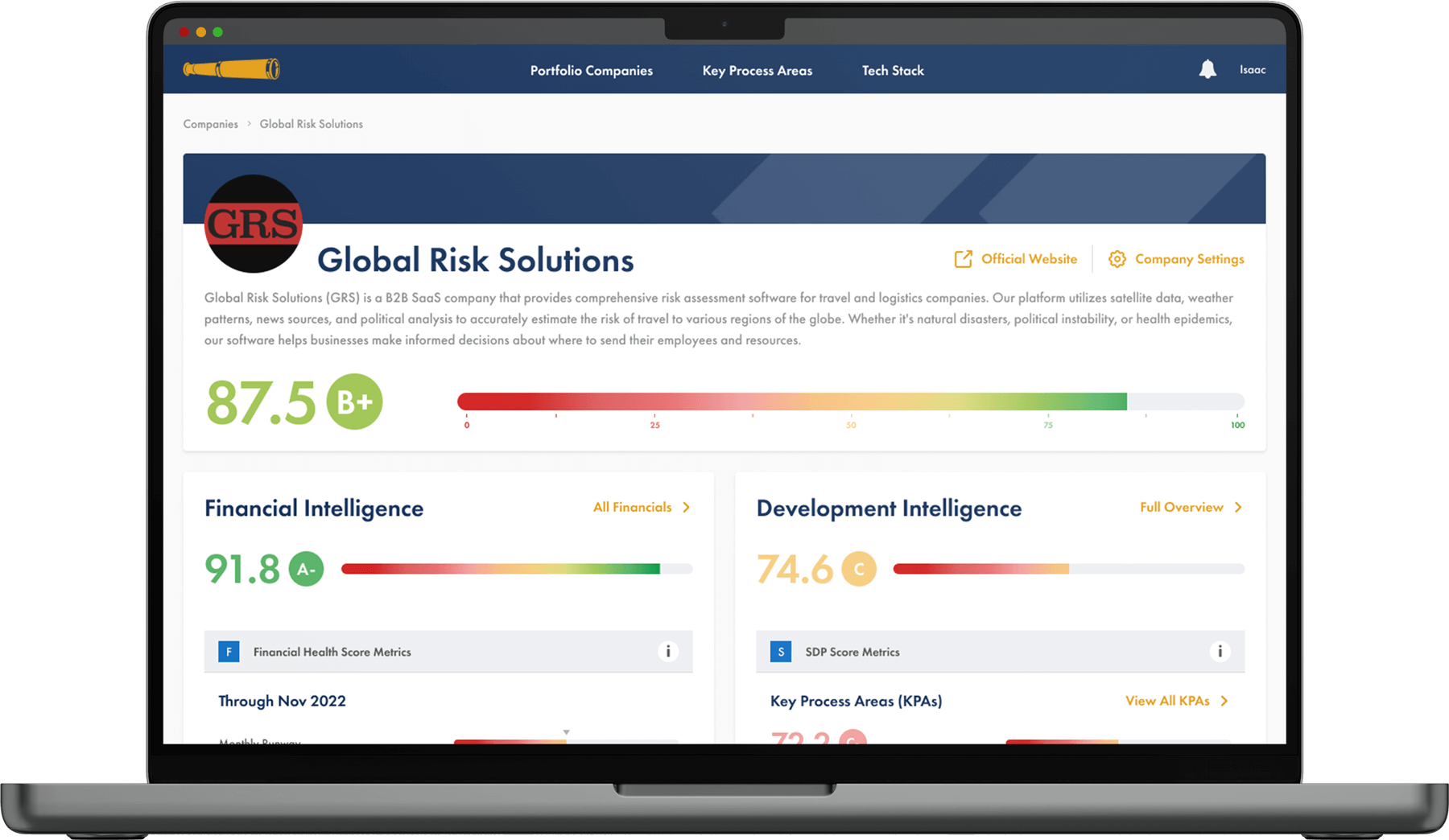

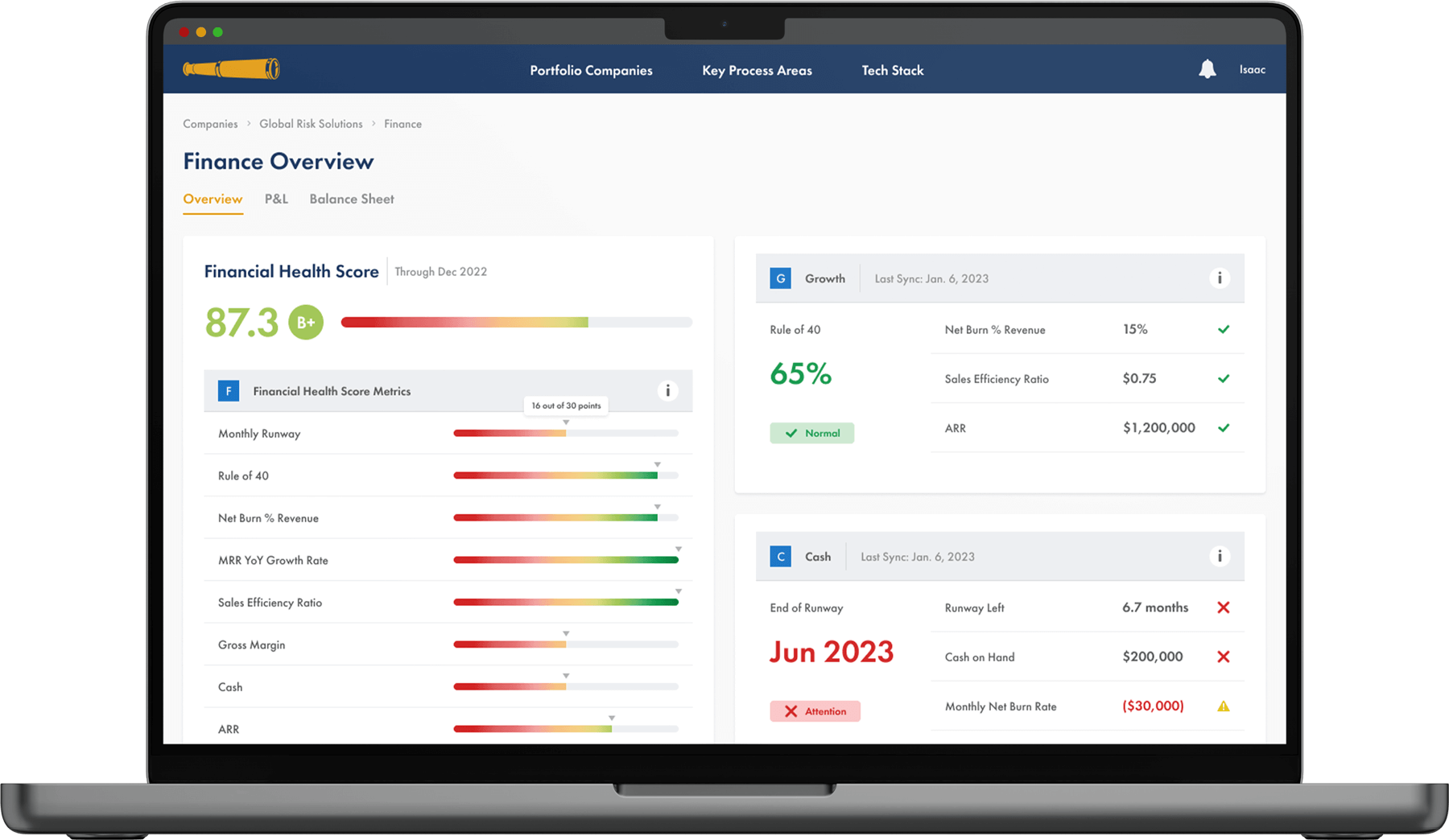

Hook up your companies' financials and let Looking Glass do the heavy lifting: LG uses a proprietary approach to finances to inform investors, recognize patterns, and allow for faster and more accurate decision-making. A New Way to Finance ⇓

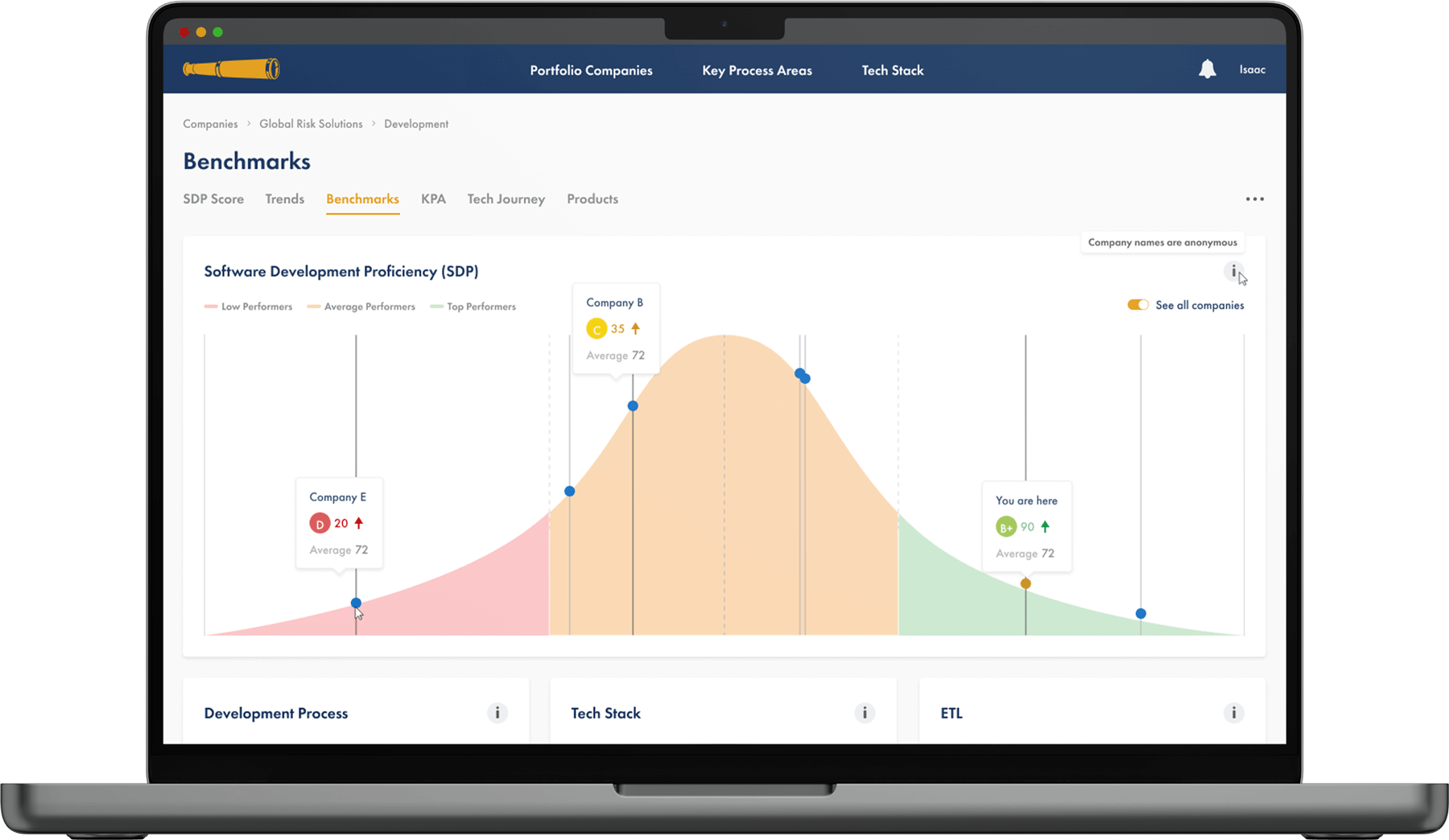

Benchmarking company performance against the patterns of past investments allows you to gain insights and quickly offer course-correcting guidance to your founders. What It Means ⇓

Looking Glass is an intelligence tool built on years of shared knowledge from a team of experienced investors in the B2B SaaS space. Learn About Us ⇓

Software is the backbone of modern investment vehicles. Looking Glass analyzes companies' software architecture, tech stack, and key process areas to give you the best assessment of their tech landscape. Let's Do a Deep Dev Dive ⇓

Cut down on time to insight. Increase transparency into companies. Run nimbly. Get started on the path today!